What are REITs and Why Lease Abstraction & Administration is Crucial for Them?

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate across a range of property sectors. REITs offer a way for individual investors to earn dividends from real estate investments without buying, managing, or financing properties themselves.

They are required by law to:

- Invest at least 75% of total assets in real estate

- Derive at least 75% of income from rents or mortgage interest

- Distribute at least 90% of taxable income as dividends

REITs can be public or private and focus on sectors such as retail, industrial, healthcare, office, residential, and logistics.

Why Lease Abstraction & Administration is Critical for REITs

Given the volume and complexity of lease agreements, Lease Abstraction and Lease Administration are essential pillars of operational success for REITs. Here’s why:

1. Data Accuracy for Investor Reporting

REITs are publicly traded entities that must provide timely and accurate financial disclosures. Clean lease data supports:

- Revenue recognition

- Occupancy and rent roll reporting

- Forecasting and budgeting

2. Efficient Rent Collection & Expense Reconciliation

Lease administration ensures:

- On-time invoicing

- Escalations and percentage rent tracking

- CAM/NNN reconciliations and recovery

3. Compliance with SEC and GAAP/IFRS Standards

Accurate abstraction ensures compliance with lease accounting standards (ASC 842 / IFRS 16) and supports internal audits.

4. Risk Mitigation

Abstracted clauses like termination rights, co-tenancy, and exclusivity protect REITs from legal and operational risks.

5. Streamlined Portfolio Management

With hundreds or thousands of locations, REITs rely on centralized lease data for acquisitions, dispositions, and capital planning.

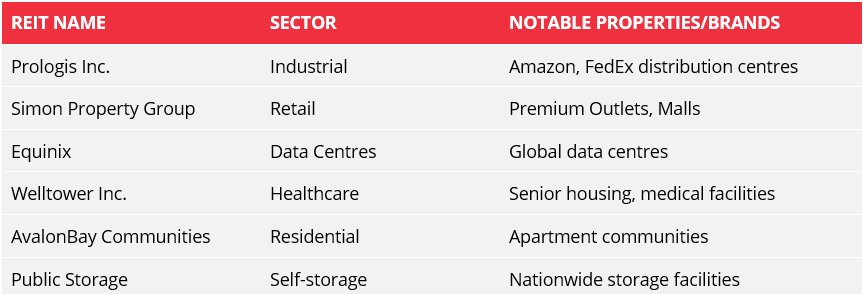

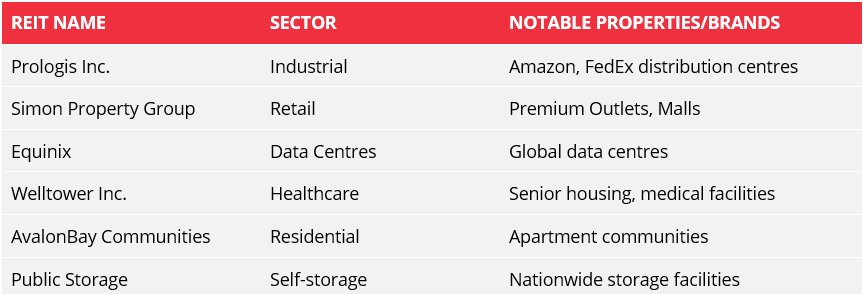

Examples of Major REITs in the U.S.

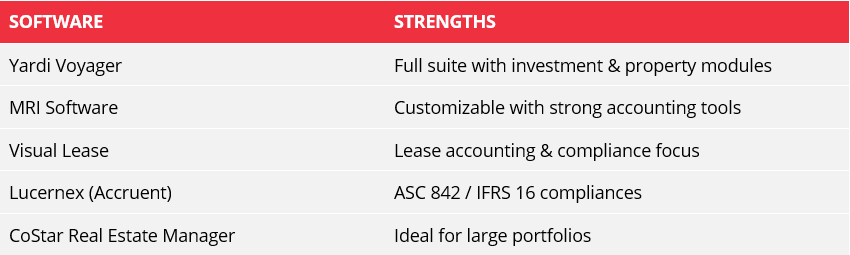

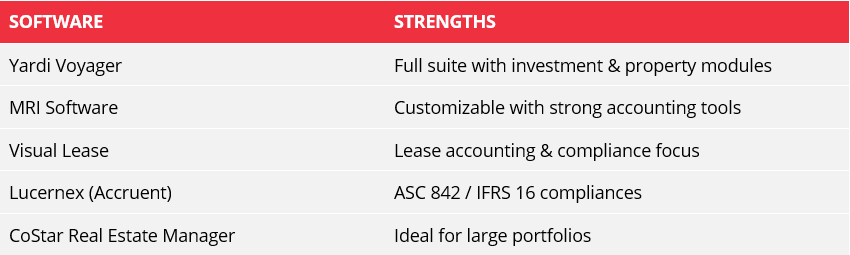

Popular Lease Administration Software Used by REITs

REITs typically require scalable, audit-compliant, and integration-ready software tools. Common platforms include:

How Mohr Partners Supports REITs

At Mohr Partners, we help REITs transform raw lease documents into actionable data and maintain accuracy through:

- Detailed, clause-by-clause abstraction

- Custom templates for office, retail, industrial, or medical leases

ASC 842 & IFRS 16-ready data sets

- Rent invoicing, reconciliation, and CAM audits

- Portfolio tracking and critical date management

- Centralized reporting and compliance dashboards

- Help REITs choose and implement the right Lease Admin platform

- Support during data migration and lease audits

- Workflow automation strategies

Final Thought

As REITs continue to grow and diversify their real estate portfolios, the demand for robust lease management increases. Lease abstraction and administration are no longer optional—they are foundational. Mohr Partners empowers REITs with the clarity, accuracy, and insights they need to scale with confidence.