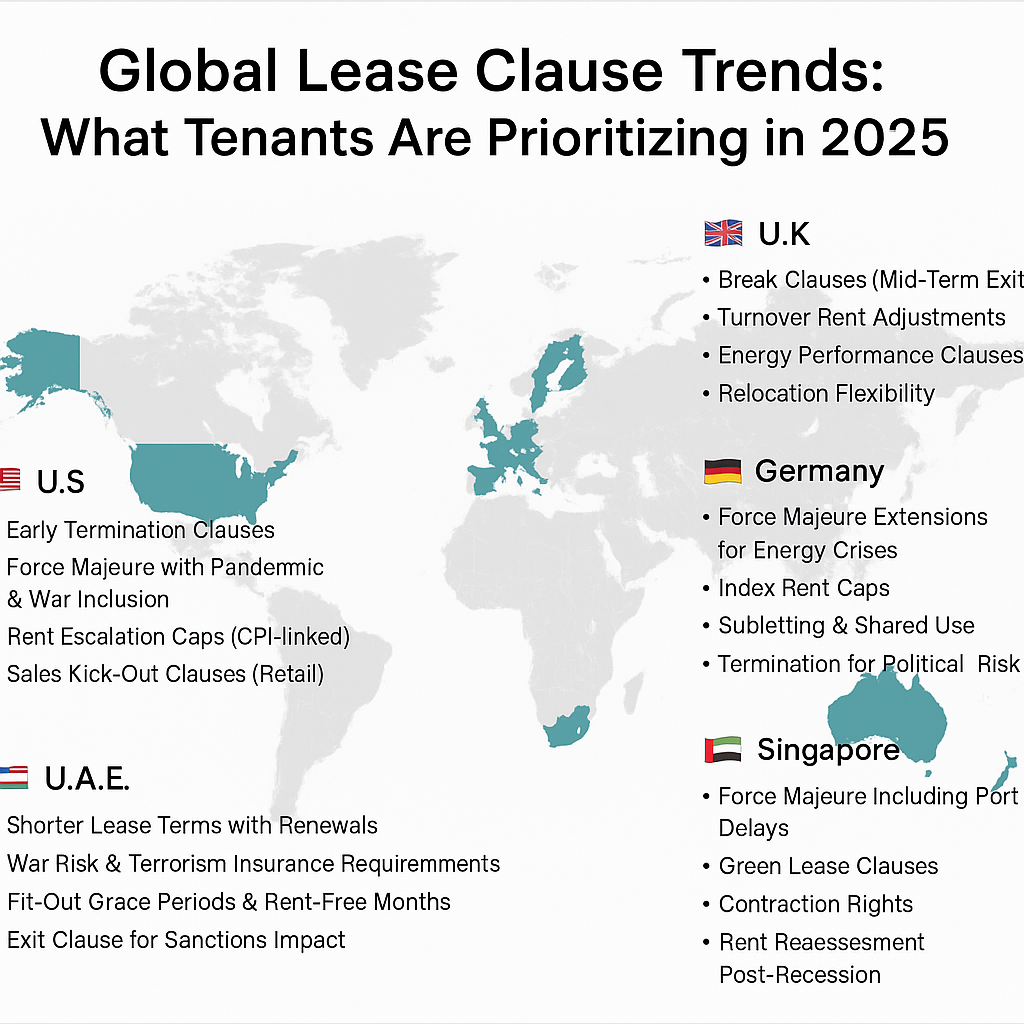

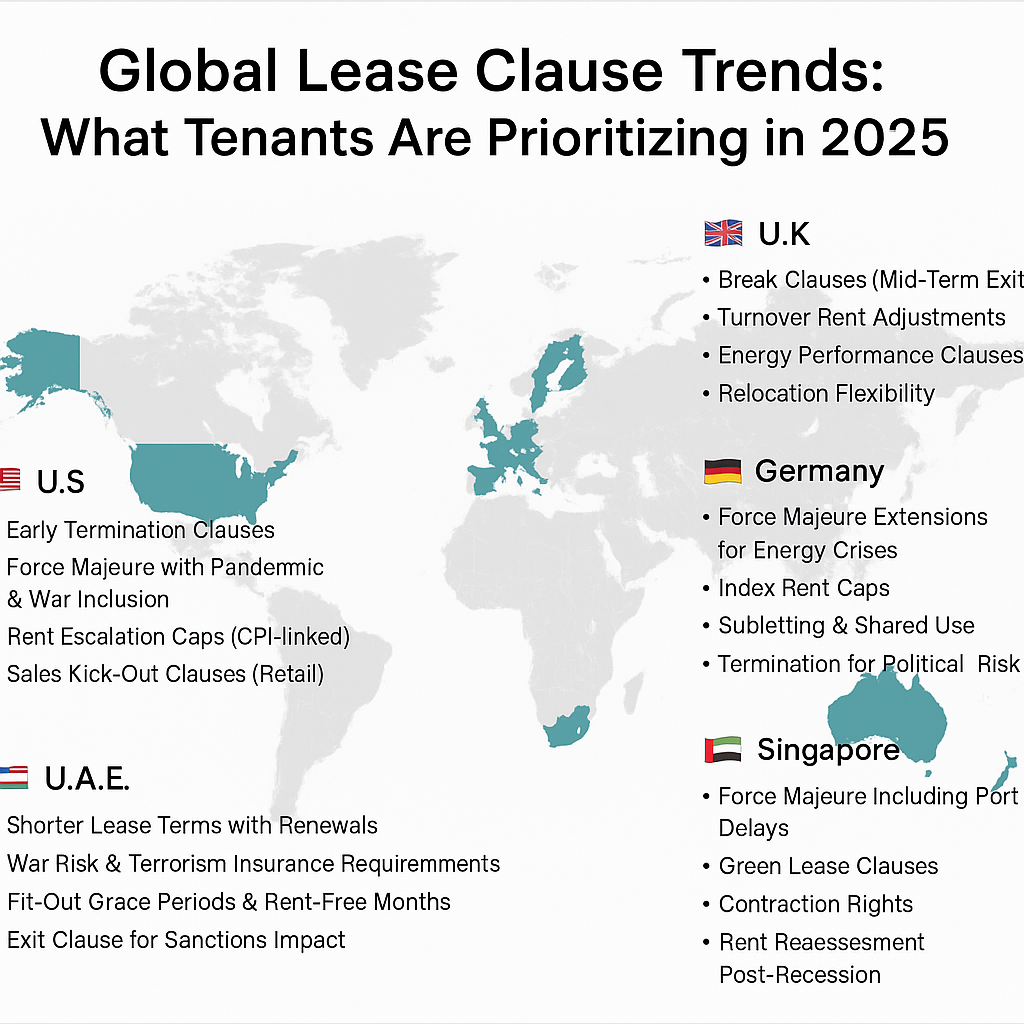

In the wake of rising inflation, geopolitical conflict, and supply chain fragility, commercial tenants are becoming more meticulous in lease negotiations. Here’s a breakdown of the top lease clauses tenants are prioritizing across key global markets:

🇺🇸 United States

Key Clauses Tenants Are Focusing On:

- Early Termination Clauses – Startups, tech firms, and hybrid office users demand flexibility to exit leases with milestone triggers (e.g., funding loss, downsizing).

- Force Majeure with Pandemic & War Inclusion – Broader definitions now include public health crises, civil unrest, sanctions, and cyberattacks.

- Rent Escalation Caps (CPI-linked) – Inflation-linked escalations with 3–5% caps are more common than flat increases.

- Sales Kick-Out Clauses (Retail) – If sales drop below thresholds due to inflation or footfall loss, tenants want exit options.

- Security & Insurance Enhancements – Clauses requesting LL to maintain cybersecurity protocols and terrorism insurance.

🇬🇧 United Kingdom

Key Clauses Tenants Are Focusing On:

- Break Clauses (Mid-Term Exit) – Especially for leases over 5 years, tenants demand clear and early break options.

- Turnover Rent Adjustments – Retail tenants are pushing for hybrid rent models based on turnover to hedge economic fluctuations.

- Energy Performance Clauses – Due to ESG mandates, tenants want the right to terminate or receive rent credits if premises don’t meet EPC standards.

- Relocation Flexibility – Due to Brexit logistics challenges, tenants seek right to move operations within the same landlord portfolio.

🇩🇪 Germany

Key Clauses Tenants Are Focusing On:

- Force Majeure Extensions for Energy Crises – Industrial tenants want energy supply disruptions explicitly covered under FM.

- Index Rent Caps – Tenants ask for upper ceilings despite indexing to the German CPI to avoid double-digit hikes.

- Subletting & Shared Use – Flexibility to sublease portions to reduce operating costs in case of demand slumps.

- Termination for Political Risk – Multinationals with cross-border operations seek clauses allowing exit in case of trade restrictions.

🇦🇪 United Arab Emirates

Key Clauses Tenants Are Focusing On:

- Shorter Lease Terms with Renewals – Due to political instability in the Middle East, tenants avoid long commitments.

- War Risk & Terrorism Insurance Requirements – Tenants insist landlords maintain specific insurance for high-risk regions.

- Fit-Out Grace Periods & Rent-Free Months – More generous setup clauses demanded due to economic uncertainty and construction delays.

- Exit Clause for Sanctions Impact – Especially for international tenants affected by regional embargoes or supply bans.

🇸🇬 Singapore

Key Clauses Tenants Are Focusing On:

- Force Majeure Including Port Delays – Tenants want coverage for delays in supply due to shipping/logistics blocks.

- Green Lease Clauses – ESG-focused tenants seek terms allowing exit or penalties if landlord breaches sustainability commitments.

- Contraction Rights – Office tenants opt for flexible area reductions due to slower workforce returns.

- Rent Reassessment Post-Recession – Leases include reassessment clauses every 12–24 months to reflect market volatility.

Multinational & Cross-Border Tenants (Global HQ Perspective)

Universal Clause Priorities Across All Markets:

- Audit Rights – Stronger rights to audit landlord’s CAM, taxes, and shared expense calculations.

- Utility Billing Transparency – Tenants are demanding clear breakdowns of utility charges, with rights to validate metering data and challenge overbilling.

- Data Security in Smart Buildings – Leases now cover data protection obligations and liabilities for breaches.

How Mohr Partners Supports U.S. and International Tenants Whether you’re navigating a complex retail lease in the U.S. or managing space across international markets, Mohr Partners delivers tailored lease abstraction and administration services to match regional risks and regulations. We help ensure your lease portfolio stays compliant, flexible, and resilient—no matter where you operate.